What are Credit Scores and Why Do They Matter?

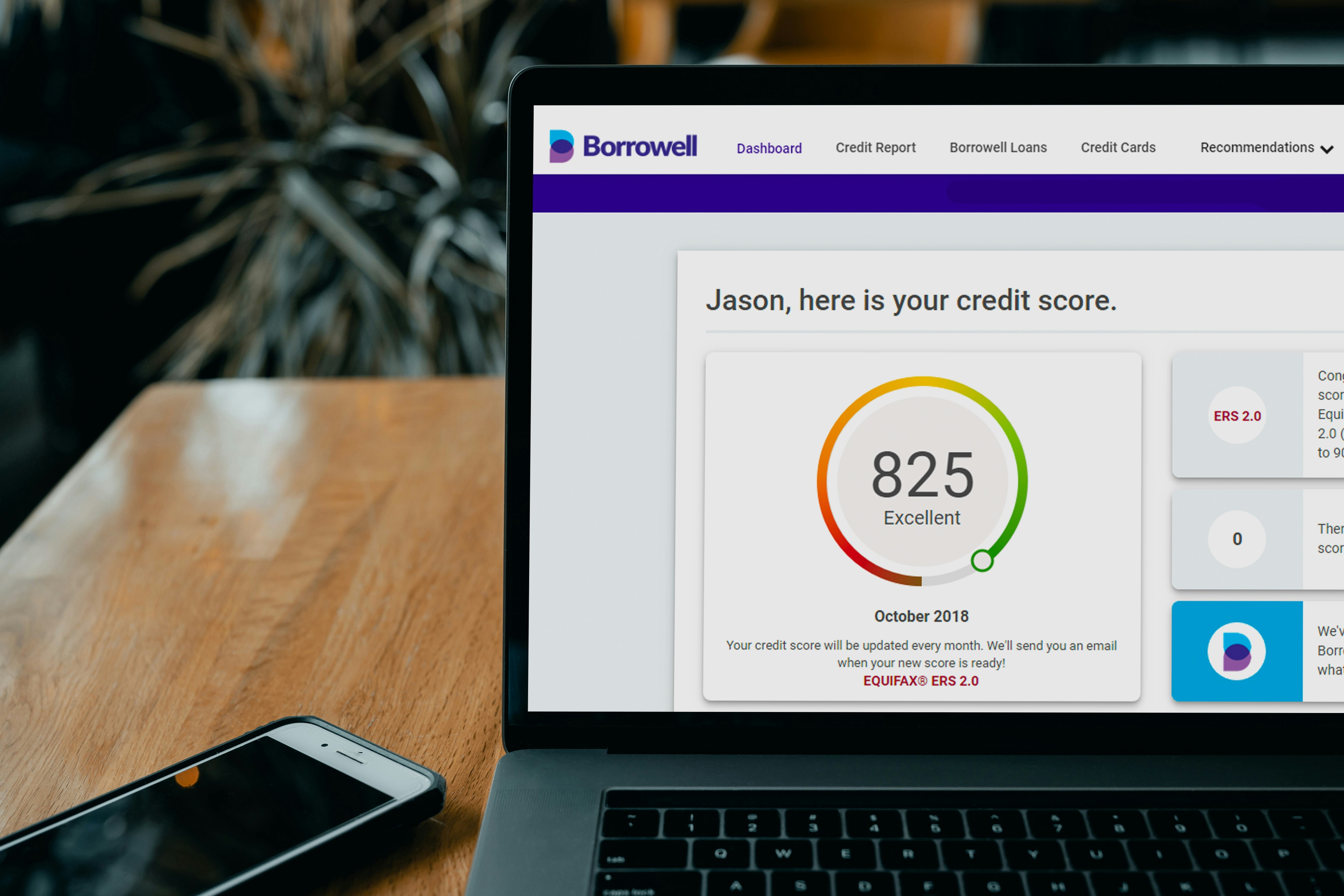

Credit scores are numerical representations of an individual’s creditworthiness, generated from a person’s credit history. Ranging from 300 to 850, these scores are calculated based on various factors, including payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. The primary purpose of credit scores is to provide lenders a quick assessment of the risk associated with borrowing money to an individual. A higher score typically signifies lower risk, while a lower score indicates potential difficulties in repayment.

The significance of credit scores extends far beyond loan approvals. They play a pivotal role in determining the interest rates that lenders charge. For example, individuals with higher credit scores often qualify for more favorable interest rates, which can save them substantial amounts over the life of a loan. Furthermore, some insurance companies utilize credit scores to decide premium rates, meaning individuals with lower scores may face higher costs for auto and homeowner’s insurance. In many cases, employers also evaluate credit scores as part of their hiring process, particularly for positions involving financial responsibilities.

There exists several misconceptions surrounding credit scores. One common myth is that checking your own credit score can harm it. In fact, this practice is what is known as a “soft inquiry,” which does not impact the score, offering individuals an opportunity to monitor their credit without penalty. Additionally, it is a misunderstanding that credit scores are solely dependent on borrowing behavior; they also reflect an individual’s overall financial management. Therefore, maintaining a healthy credit score is essential, not only for securing loans and better rates but also for ensuring overall financial stability. Therefore, being proactive about managing credit scores is crucial for one’s financial health.

How are Credit Scores Calculated?

Credit scores are integral to understanding one’s financial standing, as they directly influence lending decisions and interest rates. These scores typically range from 300 to 850 and are calculated based on several key factors, each contributing significantly to an individual’s overall creditworthiness.

One of the primary components of a credit score is payment history, which accounts for approximately 35% of the total score. This aspect reflects whether an individual has made payments on time across various credit accounts such as credit cards, loans, and mortgages. Consistent on-time payments can enhance one’s score, while late payments and defaults can result in a detrimental impact.

The second most influential factor is credit utilization, comprising about 30% of the score. This metric assesses how much of a borrower’s available credit is being utilized. A lower utilization ratio, ideally below 30%, is viewed favorably by lenders, as it suggests responsible credit management. Therefore, maintaining a balance on credit cards that is significantly below the credit limit can positively influence credit scores.

Another component is the length of credit history, which makes up around 15% of the score. This aspect considers how long accounts have been established, emphasizing that older accounts can bolster a credit profile. A longer credit history typically indicates experience in managing credit, which lenders favor.

Additionally, new credit inquiries, constituting roughly 10% of the score, occur when lenders check an individual’s credit report in response to a credit application. Frequent inquiries may signal risk, as they suggest a potential financial strain. Finally, the types of credit used, representing 10% of a credit score, examines the diversity in credit accounts, including revolving credit (like credit cards) and installment loans (such as mortgages). A mix of credit types can enhance score robustness.

Understanding Credit Reports and Scoring Models

Credit reports and scoring models are fundamental components of an individual’s financial health. A credit report is a comprehensive document that outlines an individual’s credit history, detailing aspects such as payment history, the amount of debt owed, credit utilization ratios, and the length of credit history. This report is generated by credit reporting agencies and provides lenders with insight into a consumer’s creditworthiness. Regularly reviewing one’s credit report is crucial, as inaccuracies can negatively impact credit scores and, consequently, an individual’s ability to secure loans or favorable interest rates.

There are numerous scoring models, with FICO and VantageScore being the most commonly used. FICO scores range from 300 to 850, with higher scores indicating better creditworthiness. This scoring model weighs payment history, amounts owed, length of credit history, types of credit used, and new credit inquiries. Conversely, the VantageScore also uses a 300 to 850 scale but may weigh factors differently, which can result in varying scores for the same individual when evaluated under different models. This discrepancy emphasizes the importance of understanding which scoring model a lender might use, as well as the implications for potential credit applications.

Consumers should routinely check their credit reports for accuracy and dispute any discrepancies immediately, as even minor errors can dramatically affect credit scores. The Fair Credit Reporting Act mandates individuals be allowed to access one free credit report annually from each of the three major credit reporting agencies—Experian, Equifax, and TransUnion. By monitoring credit reports and staying informed about the scoring models in use, consumers can effectively manage their credit health and work towards better financial outcomes.

Improving and Maintaining Your Credit Score

Improving and maintaining a strong credit score is essential for financial well-being and access to favorable borrowing terms. One of the foremost strategies is to ensure timely bill payments. Consistently paying bills on time demonstrates reliability to creditors and helps establish a positive credit history, which significantly influences your credit score. Setting up automatic payments or reminders can be effective tools in achieving this.

In addition to making timely payments, reducing overall debt is crucial. High credit utilization, which refers to the amount of credit you are using compared to your total available credit, can negatively impact your score. Aim to keep your credit utilization ratio below 30%. This can be accomplished by paying down existing balances and avoiding taking on new debts whenever possible.

Smart borrowing practices play a vital role in maintaining a healthy credit score. When considering new loans or credit cards, evaluate your need for additional credit and how it might affect your overall debt levels. Only apply for credit when necessary, and be mindful that numerous credit inquiries within a short period can lower your score temporarily.

Furthermore, responsible credit card use is pivotal. Utilizing credit cards for necessary purchases and promptly paying off the full balance monthly can help maintain a good credit standing. This approach not only keeps credit utilization low but also illustrates effective management of credit, favorably impacting your score over time.

Lastly, credit monitoring is an important practice that should not be overlooked. Regularly reviewing your credit reports helps identify inaccuracies or potential fraud. Taking proactive measures to protect your credit integrity ensures that you remain informed and can respond quickly to any changes that may arise.