Understanding Debt Management

Debt is a financial obligation that arises when individuals or families borrow money from lenders with the promise to repay it over time, typically with interest. It encompasses various forms, including credit card balances, personal loans, mortgages, and student loans. While debt can be a useful tool for achieving goals such as homeownership or education, unmanaged debt can lead to severe financial consequences, affecting one’s ability to meet daily expenses and achieve financial stability.

Effectively managing debt is crucial for maintaining control over personal finances and ultimately attaining financial freedom. An escalating debt level can lead to stress and anxiety, impacting not just financial health but also emotional well-being. Psychological aspects play a significant role in how individuals cope with debt; feelings of shame, hopelessness, or anxiety can hinder decision-making processes regarding debt management. Recognizing and addressing these feelings is a vital step in regaining control over one’s financial situation.

To initiate a solid debt management plan, the first step involves assessing one’s financial status. This includes evaluating total income, expenses, and outstanding debts. Personal finance experts recommend creating a detailed budget to understand regular expenditures and identify areas where savings can be made. Additionally, prioritizing debts based on interest rates and payment deadlines can streamline the debt repayment process. There are various strategies to consider, such as the snowball method, which focuses on paying off smaller debts first to build momentum, or the avalanche method, which tackles high-interest debts to minimize overall costs.

By adopting a structured approach to understand and manage debt, individuals can cultivate healthier financial habits that pave the way for a more secure future. Establishing clear goals, seeking professional advice if necessary, and continuously monitoring one’s financial situation will help in successfully navigating the often complex arena of debt management.

Debt Payoff Methods: Avalanche vs. Snowball

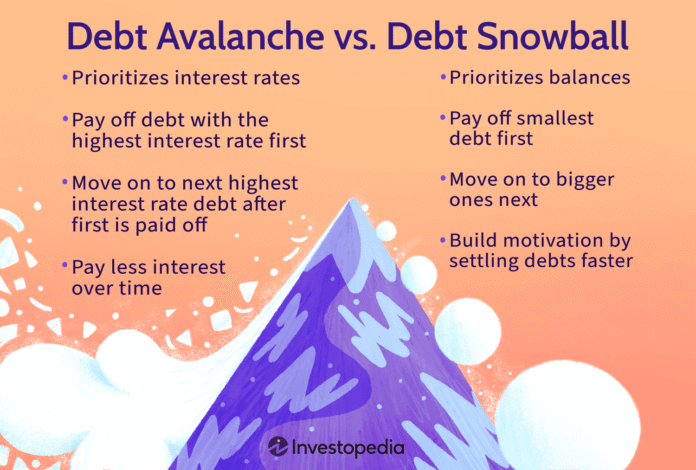

When it comes to debt repayment, the choice between the debt avalanche method and the debt snowball method can significantly impact one’s financial health and psychological well-being. Both strategies offer distinct approaches to managing outstanding debts, and understanding these differences can aid individuals in selecting the method that aligns with their financial goals.

The debt avalanche method prioritizes debts based on their interest rates. This approach entails directing extra payments towards the debt with the highest interest while making minimum payments on the others. The primary advantage of this strategy is the potential for long-term savings, as reducing high-interest debt first minimizes the total interest paid over time. This method requires discipline and may take longer to see results initially, as individuals might not witness immediate changes in their balances.

Conversely, the debt snowball method encourages repayment starting with the smallest debts. The rationale is that eliminating smaller debts quickly can provide a psychological boost, making it easier to tackle larger obligations thereafter. This method can instill a sense of accomplishment, which can be motivating for many. However, the downside is that it may lead to a higher total interest payment in the long run, especially if larger debts carry much higher interest rates.

Both methods have their merits and can be effective depending on an individual’s circumstances. If higher interest rates are predominant and saving money over time is a priority, the avalanche method is often recommended. On the other hand, if motivation and quick wins are critical for the debtor’s mental fortitude, then the snowball method might be more suitable. Evaluating personal preferences, financial situations, and psychological factors is essential in selecting the optimal strategy for debt payoff.

Exploring Debt Consolidation Options

Debt consolidation refers to the process of combining multiple debts into a single loan or payment plan, aimed at simplifying the management of financial obligations. This strategy can be particularly beneficial for individuals struggling with multiple debts, as it can lower monthly payments and potentially reduce overall interest rates. Several debt consolidation options exist, each with its own set of benefits and drawbacks.

One popular option is the personal loan, which allows individuals to borrow a lump sum that can be used to pay off existing debts. Personal loans typically offer fixed interest rates and set repayment terms, making it easier for borrowers to budget accordingly. However, obtaining a personal loan may require a good credit score, which can be a barrier for some individuals seeking relief from their debt burdens.

Another common method involves utilizing balance transfer credit cards. These cards provide an introductory period during which zero or low interest is charged on transferred balances. This can be a strategic choice for paying down high-interest credit card debt. Yet, it is essential to be mindful of any balance transfer fees and the potential for a higher interest rate once the promotional period ends.

Home equity loans present another avenue for debt consolidation, allowing homeowners to leverage the equity in their properties. These loans generally offer lower interest rates compared to unsecured loans due to the collateral involved. Nevertheless, this option carries the risk of losing one’s home if payments are not maintained.

When evaluating whether debt consolidation is the right choice, individuals should assess their current financial situation, including total debt amounts, interest rates, and payment capabilities. Additionally, seeking guidance from a financial advisor can aid in making informed decisions tailored to personal circumstances and financial goals.

Negotiating with Creditors and Staying Motivated

Negotiating with creditors can be an essential aspect of managing debt effectively. When circumstances make it difficult to meet financial obligations, it is advisable to reach out to creditors proactively. One of the first steps is to request a lower interest rate. Many creditors are willing to accommodate such requests, especially if you have maintained a good payment history. A lower interest rate can significantly reduce the total amount paid over time, easing the burden of debt repayment.

Another option is to propose a structured payment plan. This involves discussing with creditors the possibility of adjusting monthly payments based on your current financial situation. Payment plans can provide a more manageable pathway to debt elimination, ultimately allowing individuals to stay on track with their repayment efforts. Additionally, creditors may consider settling debts for a lower lump sum, primarily if the account is delinquent. This negotiating strategy is worth exploring, as it can result in significant savings.

Communication with creditors is vital. It is important to maintain transparency regarding financial challenges. Being open about your situation can foster goodwill, making creditors more likely to work cooperatively. This approach can also open avenues for flexible arrangements that align with your financial capacity.

On the journey to becoming debt-free, staying motivated is crucial. Setting realistic payoff timelines allows for measurable goals, enabling individuals to track progress effectively. Breaking larger goals into manageable milestones can have a profound impact on motivation. Celebrating small victories along the way, whether through acknowledging completed payments or simply recognizing progress, instills a sense of achievement that can sustain motivation over time. By employing these strategies, individuals can enhance their negotiation efforts while staying engaged in their financial journey towards debt recovery.